How Progressive Taxation works

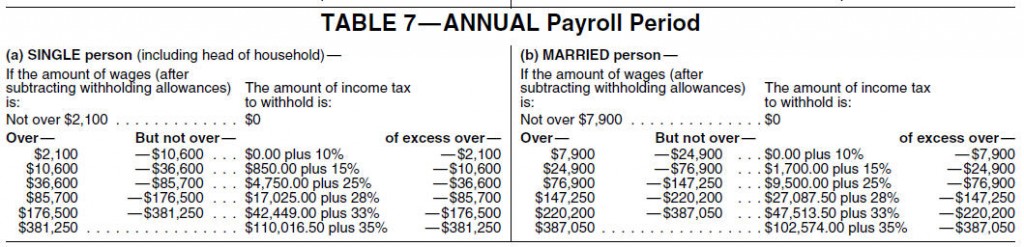

(click the tax tables to enlarge)

(click the tax tables to enlarge)

I’ve been hearing a lot about a proposal to simplify the tax code lately, using a flat tax, which would tax everyone at the same flat rate. Cain says 9%, and would add a Federal sales tax to the mix. Perry says 20%, but doesn’t mention a sales tax. The idea is that we should all be taxed the same rate, because it’s more fair, and that having one tax rate would simplify things. Well, before you fire your accountant (job killers!), remember that it’s not the withholding tables that make things complicated. It’s the exemptions and deductions and credits. So really, in order to eliminate confusion, the government could eliminate all of these deductions and credits, and treat us all the same in that way. Own or rent, married or single, kids or no kids, business expenses or not, health care expenses or not, all of that just goes away. They could then adjust the tables so that people’s taxes didn’t double because they just lost all of their deductions.

It occurred to me that I don’t think many people understand how taxation really works. I’ve been working in payroll for awhile now, so I thought I’d give you a quick tutorial. See that tax table up there? Those are the Federal withholding tables for 2011. And they’re progressive, meaning that as you earn more money, you pay a higher percentage. But the thing that’s confusing is that many people think (as I used to) that if you earn the amount in one bracket, you’re taxed on that bracket, and that’s it. Not true. If you look at the Single side there, you see that for people earning under $2,100 a year, no taxes are withheld. But really, none of us pay taxes on that first $2,100. So if you earn $75,000 a year, you pay zero on the first $2,100, 10% on the next $8,500 ($10,600 – $2,100), 15% on the next $26,000 ($36,600 – $10,600), and 25% on the last $38,400 (your $75,000 salary – $36,600). And everyone else is paying those same rates, within those same brackets, until they get to the top bracket. For those who earn $400,000, they pay all of the brackets…and only pay the 35% on the amount OVER $381,250. The $110,016.50 that you see is the culmination of all of those other tax rates, building up to the top rate of 35%. If they were truly taxed at 35%, they would be paying $133,437.50 on that $381,250.

In other words, Bill Gates pays the same income tax as I do, and the same amount you do, on the same amount of income. He pays more on the amounts he earns above what we make.

Another thing to think about is that while the top earners pay a higher percentage of their wages in income taxes, low and middle income earners pay a much higher percentage of their wages on sales tax, property tax, and Social Security taxes.

Sales tax, because they spend a higher percentage of their income than the top wage earners, who have more available for savings, 401(k), etc. If I earn $1,000 a week, it’s more likely that it will all get eaten up by medical insurance, rent or mortgage, food, gas, clothing, and so on, than someone who earns $8,000 a week.

Property tax is the same..it’s a set amount, based on the cost of your house, not on your income. So if I make less, it takes a bigger percentage of income to pay the bill.

Social Security tax is a flat tax with a wage limit. For 2012, the wage base will be $110,100. Which means that for the first $110,100 of income, everyone pays the same flat rate. But the tax stops at $110,100. For the majority of wage earners, we pay that percentage on 100% of our wages. It is only those making over $110,100 that pay a lower percentage. That lucky person making $400,000 a year pays Social Security taxes on 27.525% of their income. And the people who make the very most in this country, the people making millions, or (gasp) billions a year? They pay almost nothing towards Social Security. One could rightly argue that those at the top won’t get as much at the end, because they will have put in far more than they ever have a chance of withdrawing. To that I say, we need a safety net in this country. The problem of poverty in the aged has gone down markedly since the implementation of Social Security. It seems a small price to pay for everyone to pay this tax on 100% of their wages, and just accept it as a cost of living in our society.

So, my answers to the complicated tax regulations? Get rid of exemptions and deductions. Then it’s simple. Add more tax brackets at higher levels, so that a surgeon making $500,000 a year isn’t taxed at the same rate as a CEO making $2,000,000 a year. And eliminate the wage base limits on Social Security and Medicare.

2 Comments

Dad Who Writes

Yes, but that would be fair. And we can’t have that…

Of course, you’d have to legislate to ban advice from lawyers and accountants who help the top bracket earners avoid paying tax period!

Nance

Probably you should do a video post on this! It would go viral on YouTube and you’d be famous. Use a flip chart or a couple of PowerPoint slides and explain it like this, clear and elementary, to those of us who really just don’t “do math” and have trouble following it unless we “see it.” Go for it!