Money Monday

Kyria had a post last week where she discussed her budget and spending for the first quarter of the year, while she’s been traveling in Western Europe. She’s within a few dollars of her budget (or would be if she hadn’t had to buy a new phone and laptop, one time expenditures), and is doing well. She asked if people budget when they travel, and I said no, I spend what I spend, and she then asked if I budget in my day-to-day life. The answer again, no, not really. Then Elisabeth had a post about how she keeps her grocery bill under control. Which got me to thinking about pie charts and graphs and tracking of money spent, and also about living without much money when I was growing up.

Several of you share your budgets and what you spent every month, including how much a certain category increased or decreased from the prior month. I find these posts very interesting, because I am nosey and want to know everything. Did you spend more on groceries? What did you have for breakfast? Did you complete your 30 day workout challenge? Where is your dream vacation? These are the reasons that I blog.

I keep track of my spending in that I have a spreadsheet for bills, and I keep a checkbook so I know how much money I have. But I don’t say, “This month I’m going to spend $1,100 on groceries” and then look at the end of the month to see how realistic that was. I do watch my money. I only buy certain things when they are on sale, we put money in savings and retirement accounts, we have a separate account to save for a car down payment. We plan ahead for taxes, and we try to set aside money for travel. I don’t budget for a trip, as in, we will not spend more than $x a day, but we don’t travel if we can’t afford it, and we try to avoid eating in restaurants for every meal. We look for inexpensive hotels/AirBnB and flights, and we pay with points when we can.

So when Kyria asked if I budget, I said no, but I wonder…would you count what we do as budgeting?

My mom was a single mom, and worked in relatively low income jobs (private school teacher, Catholic charities, etc.), so we never had a lot of money. We lived in a rough neighborhood and couldn’t afford to move because that would mean not only first and last month rent somewhere else, but also getting caught up on rent where we lived. There were some very lean Christmases where there were no gifts, and my mom spent the money my Grandma gave her to buy us gifts on food.

Was my mom bad with money? If you count working in low paying jobs ‘bad with money’, then yes. It’s a lot easier to be good with money when you make enough to pay for rent, food, utilities, clothes for your growing kids, and have a bit left over at the end of the month. I didn’t really ever see her spend frivolously, she always bought the cheapest of whatever, grocery brands for food, clothes at Gemco (like Target today), used cars. Our furniture was all hand me down from relatives. Pre-sliced cheese was outside of her realm of something one would ever purchase, what a waste when you could cut it yourself and save money. Single serve yogurt? Are you insane? Microwave popcorn in a bag? WTEH*? Did she get damn sick of pinching every penny until it screamed, and sometimes put presents for her kids (or car repairs) on a credit card? Yes. I don’t think she budgeted so much as knew how much she had and tried to spend less than that. Is that budgeting?

If spending less than you earn is budgeting, then yes, I do that. I am careful with money. But I don’t track and see what has changed and how I might alter my spending, unless I am balancing my checkbook and say, “Hmmm…I feel like I have more/less money than I did last month at this time, what’s different?” Then I might change my behavior a bit based on that. But no pie charts or bar graphs.

How about you? Do you track your spending in spreadsheets/pie charts? Does it help you see where you could make adjustments? Is it enjoyable for you, like ‘gosh I love numbers, it’s fun to see everything in a pie chart and I can’t imagine how J lives her life without this fun, fun exercise?’ Is it depressing when something big comes in, like a major car repair, vet bill, or new appliances, and throws everything off chart? Also, if you keep track of your money this way, do you also track your health via a smart watch/ring? In my mind these two things are connected, and again, not something I do. I figure I sleep how much I sleep, keeping track doesn’t really help. But I’ve never tried, maybe it would.

*What The Even Heck

34 Comments

Birchie

I’m with you in that I can’t get enough of other folks’ money posts, but I use the “as long as I make more than I spend and max out my 401k it’s all good” budgeting system. I got into the nuts and bolts of what I spend a few years ago as preparation for early retirement, and I use Empower Personal Capital to keep an eye on things because it’s free and easy to use. However I don’t look at it on the level of “I spent $800 at the grocery store in March and $900 in April, man I really better rein it in”.

I started out as a penny pinching frugal with a low income (shout out to your mom!) and my young adult years were a constant experiment of what saved money and what didn’t. Today I still pursue frugality for things that don’t make a difference to my quality of life. For example, I switched to Mint Mobile last year and I adore my $15/month cell bill. But also I’ve learned to spend money in ways that bring me pleasure – hello travel! I don’t ever spend money just to spend money, but I like to think that I spend “smartly” – for example for my CA trip I used travel rewards to cover my plane ticket and the final night, I’m going to take public transport (part frugal/part adventure/and mostly because I don’t enjoy driving in large cities). For lodging though, I didn’t go for the bottom dollar. I went with locations that I believe will add to my enjoyment of the trip. I will also be eating out for pretty much all of my meals and enjoying every bite.

To answer your other questions, I don’t get thrown off by surprise bills because I know that surprises happen. It’s if and not when things break and need to be fixed, and the best I can hope is that we’re talking four figure surprises and not five figure surprises and not too many surprises in a row. I think that a lot of health tracking is bogus. I’m in a stressful period of life, and my Garmin has all kinds of data to back that up – but it’s just telling me what I already know. It doesn’t tell me what to change to handle the stress or how to get better numbers, so it’s not useful info.

J

Oh, your last point is really interesting, that your health tracker both tells you what you already know, and that it doesn’t offer solutions. I guess if one is getting worrying results, one can step back and take a look at their life and see what can change. But sometimes there is nothing that can change, it just is what it is. I think about when my mom was sick, and when Mulder was sick. I lived in such a high level of anxiety, trying not to let it ruin the time I had with them was really hard. What could be done about that? Make them better, I guess. I tried, but unfortunately both times it was out of my control. At least with Mulder he didn’t suffer.

Our HVAC system is 46 years old, and of course will die at some point. That is going to be really expensive, and every year we have with it, we consider a win. Who knows, we may be able to keep it running forever…we have really good technicians who can help us know whether it is fixable or not. Thankfully it’s pretty simple.

I’m glad that you spend money on things that bring you joy. That is so important if one can do it, and yes, travel is what I want to spend my money on as well. And my calculus is the same when picking where to stay and what to do. I think you’ll do well on public transportation here, though getting from Sac to SF won’t be straightforward. I had originally thought perhaps I would drive you, or that San would drive you part way and I would drive you the rest of the way, but now I will be out of town that day. 🙁

nance

I grew up with three siblings, the daughter of a steelworker and a stay at home mom who didn’t even have a driver’s license until she was in her mid thirties. We were poor. My clothes were always hand-me-downs from another family who had little girls. I used to go with my mom on the bus downtown to pay bills and get things from the store. I didn’t really know how poor we were until embarrassingly late in my life. I just assumed that this was the way things were for everyone, and besides, I always had library books to read, so no big deal. I had no idea how bad things were.

Rick and I married in 1981 during the Recession. Teaching and construction were both hit hard. He sold shoes and I worked at the bank. We really budgeted down to the actual penny, eating meals at our parents’ on weekends and doing laundry there as well because the washer/dryers at our complex cost money.

All of that taught me to be careful. That, and having a husband in construction, a business that can be seasonal and iffy at times. We don’t have a nuts and bolts budget, per se, but we learned to live well within or even below our means, always saving for lean times whether they come or not. It helps that we have almost identical values.

I’m extremely risk-averse, but Rick is better about risk. He also is more willing to splurge, but since he is more attuned to our overall finances, I trust him implicitly. When a big expense suddenly crops up, I get concerned (after all, we’re both retired), but I know we’ve got savings and investments. We planned very carefully and early on. If worse came to worst, we’d sell the house or lakehouse.

J

See Nance, you get it. I also never knew we were poor, not until I was a teenager and started noticing how much it bothered my mom when she didn’t have money. Before that, all I needed was a library card and a box of mac and cheese. But in her case, I don’t think we were quite so poor until then anyway. I mean, we were never wealthy, we always had the hand-me-down furniture and watched every penny, lots of rice and beans just before payday, but it was when she was trying to get her own business off the ground when I was about 15 that things got really rough.

I’m glad you have the two houses, and that one can be an emergency plan if need be. Also, you are both really good with money and have similar values, so it won’t come to that. But for a risk-averse mind, it is soothing to know there is an answer if things go really south.

Suzanne

YES so much to this: “I am nosey and want to know everything. Did you spend more on groceries? What did you have for breakfast? Did you complete your 30 day workout challenge? Where is your dream vacation? These are the reasons that I blog.”

Like you, my form of “budgeting” is paying attention to what I spend, making sure that I’m not spending more than I have, and making sure that the categories of savings and retirement funding get their due before anything else. This feels like a really luxurious way of living, though. I constantly worry that it will bite me in the ass one of these days; like what if we get to retirement and have no idea how to manage living without income? I tend to worry a lot about money, though, without really doing anything to address the worrying.

J

I feel like if you’re putting money into your retirement and savings, what else should you be doing to prepare for life without an income? I guess that’s shortsighted of me, but hell if I know. And you’re right, it is luxurious to be able to save, for so many people just breaking even is a victory.

PocoBrat

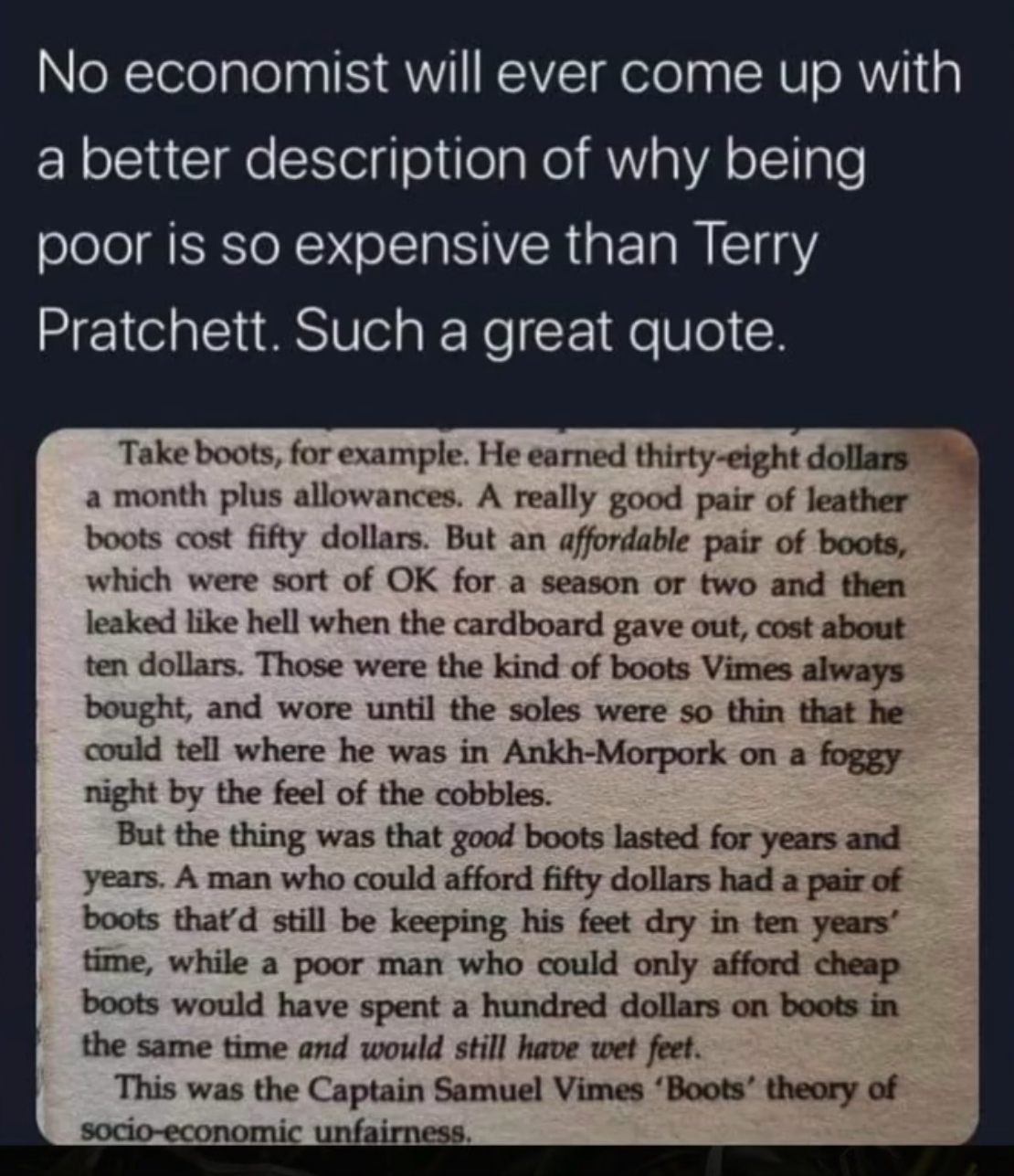

First–I LOVE that Terry Pratchett quote. It lives in my head because I’ve lived it. I kept buying knockoff sneakers until about 10 years ago–and the difference was indescribable. It was an education coming to the U.S. as a graduate student and having to figure out money and all that comes with not having it, when I didn’t have to worry about any of that back home.

I came to this country with exactly 500$ and spent about 30$ on plants for the office I shared with two other grad students and 75$ on plants for my room in grad housing in my first week. That’s how terrible I was. I’m way better now, but I’ll never be pie-chart efficient.

If you think a pie chart would give you clarity, I hope you’ll go for it, J!

J

I love that that snippet from Pratchett lives in your head, Maya. My mom was a huge Pratchett fan, but I’ve never really given his work the chance it likely deserves.

The snippet that lives in my head in this way is from Barbara Kingsolver’s book, _Flight Behavior_, when an ecologist comes to the door of an impoverished woman in Appalachia to try to help her learn about more sustainable choices she might make.

“Number one. Bring your own Tupperware to a restaurant for leftovers, as often as possible.”

“I’ve not eaten at a restaurant in over two years.”

“Try bringing your own mug for tea or coffee. Does not apply, I guess. Carry your own cutlery, use no plastic utensils, ditto ditto. Okay, here’s one. Carry your own Nalgene bottle instead of buying bottled water.”

“Our well water is good. We wouldn’t pay for store-bought.”

“Okay,” he said. “Try to reduce the intake of red meat in your diet.”

“Are you crazy? I’m trying to increase our intake of red meat.”

“Why is that?”

“Because mac and cheese only gets you so far, is why. We have lamb, we produce that on our farm. But I don’t have a freezer. I have to get it from my in-laws.”

Mr. Akins went quiet. His dark eyes swam like tadpoles behind his glasses.

“Is that it?” she asked.

“No. There are five other categories.”

“Let’s hear them.”

“No really. You came all this way. To get us on board.”

“Okay,” he said, sounding a little nervous. “Skipping ahead to Everyday Necessities. Try your best to buy reused. Use Craigslist.”

“What is that?” she asked, although she had a pretty good idea.

“Craigslist,” he said. “On the Internet.”

“I don’t have a computer.”

Mr. Akins moved quickly to cover his bases. “Or find your your local reuse stores.”

“Find them,” she said.

“Plan your errand route so you drive less!” Now he sounded belligerent.

“Who wouldn’t do do that? With what gas costs?”

He went quiet again.

“What are the other categories?” she asked.

“Home-office-household-travel-financial. We don’t have to go on.”

She put down the binoculars and looked at him. She’d lost track of the butterflies anyway. “Let’s hear financial.”

Mr. Akins read in a rushed monotone: “Switch some of your stocks and mutual funds to socially responsible investments, skip, skip. Okay, Home-slash-Office. Make sure old computers get recycled. Turn your monitor off when not in use. I think we’ve got a lot of not applicable here.”

“Okay, this is the last one,” he said. “Fly less.”

“Fly less,” she repeated.

He looked at his paper as if receiving orders from some higher authority. “That’s all she wrote. Fly less.”

I love that you spent over 1/5 of your money on plants. Priorities, right? I’m afraid when I moved on my own, I made lots of decisions that were worse than that, too many cute clothes on credit cards. Not enough thrifting.

I doubt I will ever get on the pie chart bandwagon, but I do like looking at them when others do them!

PocoBrat

J, I haven’t read this Kingsolver (she is so prolific!), so thank you for this extract.

Yes, do-gooders are sometimes so shamefully out of touch with the real lives of people they want to “help.” This is another piece that will live in my head, so I suppose I should go read the book soon.

J

Kingsolver has written SO MANY BOOKS, it’s true. I love some of them, hate a few, others are so-so. She can get a little preachy for me, even though I completely agree with the sermons.

AC

I budget pretty well how you budget. I set categories on a spreadsheet: food, untilities, property tax etc. But that is more or less for general tracking and I will move $ between categories as required.

That Pratchett quote is spot on. Some people can’t take advantage of sales (how about meat, for example) because this only have so much $ for what they need this week, or whatever the nit of time happens to be.

J

Regarding the unfairness and not being able to afford better quality, YES. I’m thinking about credit cards, and how the lower interest rates go to people who pay off their cards every month, and who NEEDS a lower rate is people who have to carry a balance. In reading the snippet from the book, I was struck that even the cheap $10 boots were almost 1/3 of the character’s monthly earnings. There’s no way I could ever afford boots that expensive, let alone boots that cost MORE than my monthly earnings. Crazy.

Nicole MacPherson

This: “If you count working in low paying jobs ‘bad with money’, then yes.”

I have a similar “budgeting” to you – I track what I spend in a spreadsheet, but I don’t really look at what’s changed month to month as there are a lot of variables at play here. Did we travel? Then the groceries will be less. Did Rex have a vet visit? That will be more. Etc. We spend less than we make, I consider that to be on budget, but I don’t say “I have x to spend on groceries” and then stick to that.

I do track my health information, mostly for interest’s sake. I like knowing daily steps, RHR, etc., but I’m not going to be upset if those things change week to week.

J

Clearly there is huge market for fitness trackers, and some of them can be really useful. My doctor told me that a woman’s app told her she was having an irregular heartbeat, and she didn’t even feel it. But she was, and they were able to treat her. Which made me wonder, did she NEED treatment? Is an irregular heatbeat at that level always dangerous? If so, we should all get some device I guess.

Elisabeth

Do you track your spending in spreadsheets/pie charts? We don’t – and have never had a set budget. In general we always used to spend as little as possible. Now, we spend quite a bit more but always with an eye on frugality. We splurge on things that matter to us – like nice pasteries in Paris – but we aren’t particularly fancy folk 🙂

I rarely make adjustments based on what I see from recording our spending. I put all the information into a spreadsheet at the end of each month, but it’s more to see spending habits over time.

I do track health data. I actually feel the flip of Birchie – having something telling me that my temp is elevated or there are signs of stress make it feel more legitimate to me. So often I would not feel great and would think I just needed to buck up; now with my Oura ring, it gives me a heads up when I’m likely getting sick. I also LOVE the period tracker because it’s super accurate since it’s measuring my temp every day. I don’t do much with the data, but I find it interesting, same as with the financial side of things.

J

I think a period tracker would be really useful, especially if one is not SUPER regular. I was on the pill for most of those years, which kept me really regular, so almost never had a surprise. But obviously lots of people are NOT going to choose that method of birth control.

Tobia | craftaliciousme

I am more or less winiging it liek you do.

Every year I sit down and do a check in what the current fixed costs are. Since being self-employed this is my basis for setting my rates. This also tells me how much I need to earn and if I give myself a rasise or not. (I usually dont as I try to go with the least amount of money if possible) .

I know many prices in the sstsores I freqent and can see if something is on sale or not and then I might get some more of that item.

We never really budget on vacation. I want to see the world and the husband wants to travel like the jetset. If we would budget here either of us would not be happy so I have givene up here. However if I find a deal and it fits we’ll take it. After our Mallorca trip two years ago even the husband said we went a little overboard.

I have been very priviledged when it comes to money as I never really experience a shortage if I am being honest. I have put spressure on myself that I am low on funds and such but I ´had never to pinche pennies to get food or rent. I am very lucky in that regard.

J

Being self-employed gives you a whole new layer to budgeting, whether you get a raise or not, whether you need to increase your prices, whether you can offer a discount to bring in more business, that kind of thing. But for your household finances, clearly not as vital. 🙂

Lisa's Yarns

Oh this is such a fascinating topic. Money is such a tricky topic. I try to talk about it more on my blog to normalize conversations about money but I also recognize that I am incredibly privileged since the industry my husband and I work in is a very well-compensated one. Phil and I didn’t even talk about how much we each made until a few months before we got married. I remember a friend was floored when I told her that, especially since we had always planned to merge our finances.

But back to the topic at hand. I track our spending using Fidelity. We used to use Mint but it went away. The Fidelity money tracking ap is not great so we might need to pay to track it. It’s more of an observational type of exercise, though. We are both kind of naturally frugal, especially Phil. We rarely eat out and live a fairly simple life overall. So we don’t really ‘need’ to budget. But I like to see trends of whether things are increasing or decreasing. The only practical benefit of tracking is that it makes it easier to calculate our charitable contributions for our taxes.

I grew up middle class but we rose to more upper middle class as I got older. I know my parents started off quite poor. They tell this story about going out to eat for their 5th or 10th wedding anniversary and they only had $10 to spend so my dad got all huffy and said he just wouldn’t eat. Instead they both ordered a bowl of mulligan stew. My mom made all of my brother’s clothes when he was a baby/toddler as that was cheaper than buying clothes. I think she made clothes for my dad, too. They ingrained in us that you should not spend more than you make. Granted, sometimes your ability to make money is so constrained, like your mom’s situation, and there is no pulling yourself up by your bootstraps…

J

I always enjoy the money posts that you share, and I love normalizing money discussions. I think it can be really helpful for folks.

Your parents went from being broke to upper middle class income, that is the dream, isn’t it? So wonderful that they were able to do that.

And you’re right, sometimes it is really difficult to pull yourself up by your bootstraps. Being a single woman at a time when women were really held down in a lot of professions hurt her for sure.

Ernie

I’m not one to budget either, but I’m frugal. My dad was so over the top at budgeting when I was growing up that it really turned me off. He sort of forced his ways on my when I was first married and I wish I’d been better at setting boundaries right off the bat. Eventually I told him it was none of his business. His budget focus served him well, but I’m spread a bit thin and I don’t feel I have time to track everything we spend. I just do my best, trying to save whenever I can. I’m careful with money and buy things on sale – almost always, except for food. I stock up on groceries when items we eat are on sale.

When we got married, Coach was a full time student getting his masters in Physical Therapy. I shopped at the Hostess Day Old shop. I made gifts for my nieces and nephews, and baked dinners for my younger brothers as their Christmas gifts (It’ll come as no surprise to anyone who has read my blog that my sister Ann made fun of me for this). We scraped and saved. I was a stay at home mom. We were really tight with our money. We took the kids on camping trips, because it was a cheap way to travel. I shopped at resale shops and garage sales. I cut everyone’s hair and we rented our videos from the library, because they were free.

I come from a long line of frugal people. My mom’s family was poor. Her dad never finished high school. My dad’s parents surived the Depression. They did well, but saved every penny and would not wear a new sweater if we bought them one as a gift, because the old one they wore worked fine (even though there were holes in the elbows). My dad and his father discovered the stock market and they started investing. They did pretty well.

Both my dad and my grandpa gifted stocks to us and to our children. Their generosity helped pay our kids collegee tuition. My dad was bothered for years that Coach and I weren’t more invovled in watching the market and choosing how to invest our money. It took a few decades, but now I am comfortable saying There are people who do that, and we have people who do a good job tending to our investments and advising us. I’m OK with that.

All that to say, we’re where we are today because of the savings and investments of my dad/grandpa, and because I was raised to be careful with money. Fortunately Coach is frugal too. When we travel, we look for the cheapest flights and we eat as many meals without a restaurant as we can. In grade school and high school, I saved so much money from my babysitting gigs (like I rarely took a break), and our kids work like dogs as caddies and they save almost every penny.

I cannot be bothered to put our spending into a chart and see how much we spent on groceries last month. It’s usually a lot, and I don’t see that changing any time soon. I also do not track my sleep or my steps. I can tell when I slept like crap.

J

It sounds like you’ve done well, and that your dad and grandpa were a big part of that. But also, saving money instead of spending it is really important, and something that takes some people a long time to learn. But not being willing to wear a new sweater that was a gift? That’s a step too far to me. Life is to be enjoyed. I could see not buying a new sweater, but wow. It sounds like you and Coach have a good balance.

Margaret

I’ve never used a spreadsheet and don’t really budget. I had to when I first started teaching and money was extremely tight. I watch my checking account and credit card expenses as well as the money I have coming in and spend accordingly. I wish I were more systematic about it but I tend to be OCD so I don’t want to get overly nit picky about money.

J

Eh, I think what works for you works, so no need to add a new complexity to your life. And you’re self aware enough to know that it could become something that makes you miserable, so that’s another reason to NOT do it.

Tamara

Such an interesting post, and take on money talk and budgeting. Thank you for sharing your mother’s story. I live carefully but also try to give my children the feeling that we have enough. This is partly compensatory. I have organised my life around not driving for environmental reasons and I am likewise very careful about meat and recreational travel. But also, I am an immigrant without property or family ties and my partner and I are late in life academics who have lived at least partly on soft money for their entire lives. They feel different than their peers and sense that we lack in some ways. The big concern now is retirement. The pandemic dried up my partner’s funding and he is nearing mandatory retirement with no pension. We can’t move country because we cannot afford to give our kids an education anywhere else. I’m holding us all together in two countries on a modest salary but putting nothing into my own pension. It sounds very grim but I think a lot about how I will manage my end of life to avoid burdening my children because I know that I will not have enough money to care for myself. As you point out, I don’t need data- I need resources.

J

See, this is exactly the problem isn’t it? So many jobs are so precarious, like acadameia where one is dependent upon funding sources, like work in IT, like work in radio (where my husband worked for many years, after giving up his dream of being a professor due to lack of tenure track positions, SO I HEAR YOU). You don’t need a budget telling you how much of your money goes to electricity or rent/mortgage, you need more money. Full stop.

K @ TS

I love this post! I think you summed it up pretty nicely in that you spend less than you earn. I know my post talked about my “budget” but as I said in the end it really is kind of arbitrary in that I am okay if I go over, but it’s kind of my target. I am actually similar to you and to Birchie in that I know how much is coming in, so I always made sure u was spending less than that and ideally saving for retirement and maintaining an emergency fund on the side. Of course now I am technically living on my dividends, so I still have a finite amount, but I could sell or dipminto my emergency fund if needed, and it would not be the end of the world.

Like both of you, I usually did not “budget” for travel, but I always kept (and keep) track of my spending so I can be aware and if I need to make changes I can. But if my Mom wants to take an expensive cruise to Alaska, I will jump on that because time is more important than money!

Also I am like your Mom; I can cut my own cheese! I am not one to buy many things for convenience when it’s entirely possible to do it myself. However, if I don’t feel like walking, which is almost never, I will take a cab. I will not deprive myself but I feel like I am also just not a frivolous person. Woof! Sorry so long! I could go on for hours!

PS I loved reading everyone’s comments!

J

I really enjoyed reading the comments too, Kyria, and now I feel better about my lack of budgeting. It looks like I do actually budget a bit!

Not frivolous but not depriving oneself is a PERFECT way to live, I think.

Daria

This is so great- thank you Julie for sharing with us.

I can’t do pie charts or graphs- I simply don’t know how to and no particular desire to learn.

We use Monarch money to track everything- and yes I do set a budget for categories but it’s never works out perfectly. One month it’s over, another month it’s under. What I find helpful is if we are majorly over e.i in March our restaurant and take out was higher than usual- so yes, I wanted to reign it in. Our two biggest spending categories are : mortgage and investments.

In March and April, however, we have had major maintenance repairs to both of our Subarus- a necessary expense if we want to keep those cars running.

Also, some trees in the back yard were dead, on the verge of collapsing onto our neighbors’ yard, so we removed those. AC system needed a tune up. I had my spring break road trip.

As you may know, I grew up in the Soviet Union, which later became Russia, and we were very poor. My mom was stay at home, dad worked a low wage job. But many things were free: higher ed, all after school activities, lunches, some self-grown food was from the summer house garden, medical care.

To sum it all up, I am very careful with money. I wouldn’t I am cheap, because I do spend, but I only spend if I absolutely love it. Or it’s for travel 😉

J

I feel like if one can manage it, travel is SO WORTH THE MONEY. I remember you fretting over buying yourself a scarf because you didn’t want to spend the money, and you had the money, just wanted to use it elsewhere. I don’t think that’s cheap, I think that’s realistic, and the fact that you came from a poor background probably makes you more careful.

It doesn’t always, of course. One of my friends grew up poor, and recently came into money, and went on QUITE A SPREE of things they DO NOT NEED. She got really tired of never having anything, which I understand too.

Stephany

Ooh, I love this. I have such a fraught relationship with money because I grew up very similarly to you. My mom was a single mom and we struggled a lot with money. My mom used food stamps and there were times when we would go over to my grandparents’ house just to raid their cabinets because my mom didn’t have money for food. She even went back to school SOLELY so she could get a loan that she could use for our living expenses.

When I started my career, I was making $25,000/year (in 2011) and then got a new job in 2013 where I was making $35,000 and thought I was making the big bucks. But things were still such a struggle for me. I had a maxed out credit card, my mom had to cosign my car loan, and I had this huge ER bill I couldn’t pay (because I didn’t have health insurance when I had to go to the ER; my mom couldn’t afford it).

Anyway, I’m in a much different financial place now, and so is my mom. But I still feel like I’ve never quite GRASPED finances in the way others do. I’m financially stable now, but thinking about things like stocks and investments and all that OTHER money stuff makes my brain melt. I am really envious of friends who grew up with financial stability and could learn about the stuff beyond budgeting and saving.

I would probably say that you DON’T budget, but you still watch your money. I feel like budgeting is trying to stick to paying a certain amount of money in certain categories, and not spending money when you have used up the allotted amount of money. IDK. By that measure, I don’t really budget either. I should do a better job of budgeting, but itemizing my spending does help me keep an idea of the areas I need to cut down.

I do keep track of my money via a spreadsheet and no, I do not consider it fun. It’s just necessary for me to keep track of my spending. And I do use a smartwatch to track health data! I find it fascinating, lol.

J

I’m with you Stephany, I don’t really invest other than my 401(k). It feels too much like gambling to me. My uncle made a lot of money that way, my cousin makes good money that way, but I’m always afraid to put real money in there. The fact that my 401(k) has taken such a huge hit over the last few weeks has not made me feel more comfortable about it either.

NGS

I track what I spend and save, but I hate every bit of it. It makes me so nervous. There is literally never going to be enough money to make me think it’s okay to spend it. I grew up in poverty without enough to eat and I know it’s important for me to know how much money I have and how much I spend, but I literally get sick to my stomach whenever I pull out the spreadsheet.

Sometimes Kyria and Birchie do these “travel hacks” posts where they talk about different credit cards and reward programs and I can’t even read them because they make me feel stupid and like I am adulting WRONG. And I probably am. But I get that it’s fun for some people. It’s hard for me to believe that, but it is what it is, I guess.

J

Oh goodness, I had no idea you hated doing the amazing pie charts that you do, I thought you enjoyed it! I’m sorry if my credit card point posts were so horrible for you. I post them for others who love the practice. My Ted could not care less about the whole thing, and there are a LOT of points we are missing because of that, but oh well.

We were poor sometimes, but we always had enough to eat. I’m sorry that wasn’t the case for you, and glad that you are no longer living that way.