Money Monday

The meme above has nothing to do with anything, it’s just cute. Today’s post is for those of you who enjoy credit card points. Credit to Sarah for the blog post title.

[Update to add: Here’s the TL;DR version if this kind of stuff is confusing. PayPal has a MasterCard Debit card where you can get 5 cents for every dollar spent on 1 category per month. Unlike a credit card, you load the card with funds and then spend them, so there is no interest to worry about.]

Like many of you, I enjoy earning money on my purchases via credit card points. I don’t really try with hotel or airline points, as I feel a bit more in control when I just have cash to use when and where I want to, and I’m not sure I want to be tied to one airline/hotel/etc. I have a variety of cards that I use at different places, and I save the points/money for travel. One of these cards has an annual fee, but I have to get the $700 in rewards off of it before I can cancel it, and sadly I can only get the full value if I use it on travel, and we don’t have any planned this year. Kyria had a whole post where she explained how you can transfer points from one card to a rewards program, but I haven’t looked into that. Perhaps I should see if that’s an option before my card renews and charges me the $59 annual fee. Sigh. Anyway. [Update – I checked, and I can transfer these points to a reward program, but I don’t belong to any reward programs and don’t want to be locked down to one airline/hotel since we are not loyal. So they will stay where they are for now.]

I have told you how I started using a reverse vending machine in front of my local Safeway to recycle the eleventy billion seltzer water cans we go through every week. I get 5 cents per can (CRV = California Redemption Value), and when you redeem your balance, it goes to your PayPal account. When I transferred my $6.25 over to PayPal the other day, I was offered a new debit Mastercard that would give me 5 points per dollar in the category of my choice. This sounds like a great deal to me, so after doing a bit of research, I signed up. Here are the specifics:

- Once you sign up for the card, it is immediately available for you to use via your smartphone. I have an iPhone, so I added the card to my Apple Wallet.

- This is a debit card, so you load money onto it, then spend it. This seems like a great way to earn points if you are nervous about putting your charges on a credit card and paying it off every month, or if you carry a balance on your credit card sometimes.

- You have to choose your category every month, it does not carry over. Options are: Groceries, Gas, Restaurants, Clothing, and Health and Beauty. You will earn 5% cash back on that category.

- The maximum you can earn per month at the 5% level is $50, so $1,000 worth of spending.

- Shopping in other categories gives you varied level of cash back. 3% on PayPal purchases, 1.5% on other items. There are other deals I have not yet explored.

- There is no annual fee.

- There are foreign transaction fees, so probably not the best card to use overseas.

- You can withdraw money from certain ATMs (MoneyPass) with no fee, but if you use a non-MoneyPass ATM, there is a charge.

- Because it’s a debit card, you (sometimes) have to enter a PIN at check out. This threw me off, since I’ve been using credit cards for my groceries for several years now.

So far as I can tell, you can keep selecting the same category from month to month. Assuming this is true, it means that I can earn $600 a year in cash back on groceries, because I am pretty sure I spend about $1,000 a month* at grocery stores.

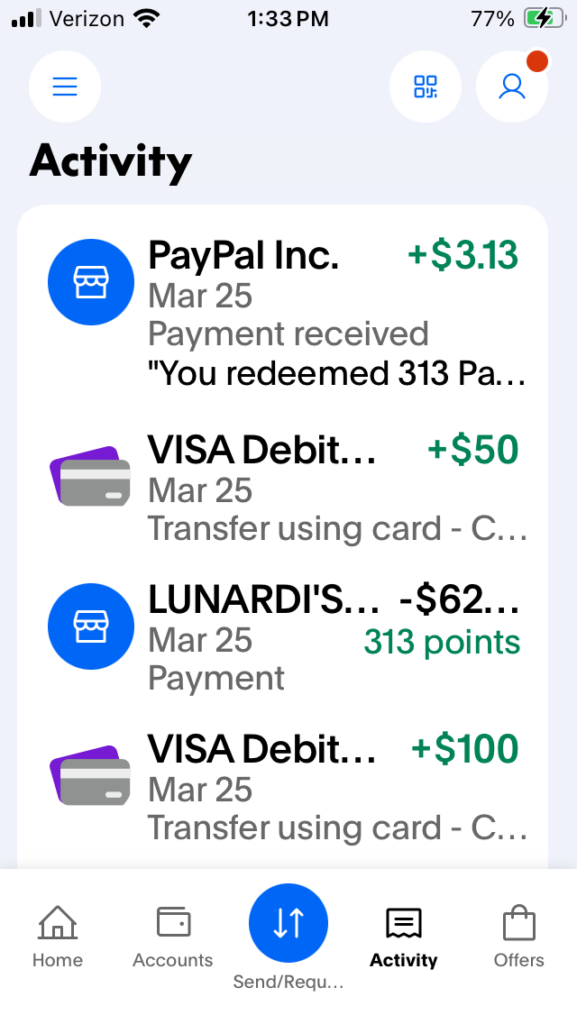

Below is my Day 1 Test from last week, very satisfying.

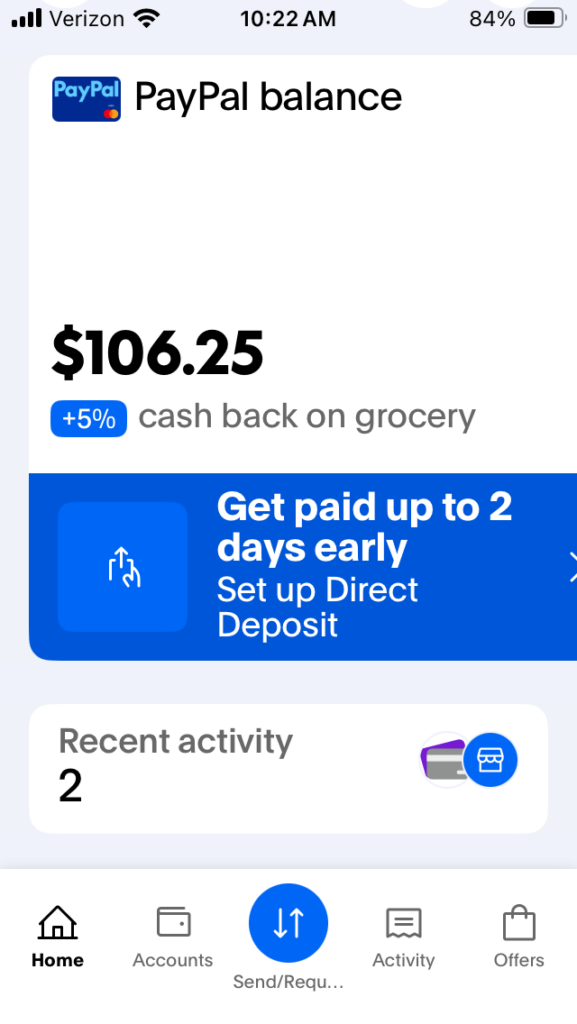

Here is my screen after I loaded $100 from my bank Debit Card (immediate transfer – you can do other types of transfers that may take a couple of days) on top of my $6.25 from recycling cans. As you can see, I have selected my category for the month, “grocery”. I also set it up to automatically reload $50 if the balance goes below $50.

Then I went to the grocery store. I spent $62.56, which brought my balance down under the $50 threshold, so it automatically loaded another $50 from my checking account to PayPal. I came home and checked, and it had already credited me 5% on that purchase, which was $3.13. I redeemed it, and then my balance increased within about 15 minutes. Talk about (practically) instant gratification! I know Stephany has been considering a points card, and I think this might be a way to ease in without worrying about accruing interest. I’m glad I found this, so I can get the maximum amount of cash back on my grocery spending, as that is my biggest spending category.

What I Learned

If you keep the balance in this account pretty low, but do a lot of shopping (say, for a birthday party), you’re going to keep hitting that low balance, which causes hiccups. I bought groceries that took my entire balance twice, and the reload is fast, but still I had to run it through twice. Example: If I had $100 in my account, and my groceries were $125, the $100 would go through, then I had to run it through again for the other $25. Which put me below my $50 level again, so it tried to reload again, and my bank got suspicious and sent me a text to confirm that it was really me. This started bugging me and was making my checkbook untidy, with all of these PayPal transfers (I mean, I could have combined them in my check register**, but I didn’t.)

So I decided that instead of transferring over a bit at a time, I would transfer a month’s worth. That way, when I get to the point of reloading, I will know it’s time to switch to another card for the remainder of the month, since I will have maxed out the 5% benefit. So I transferred $1,000 over from my checking to the PayPal Mastercard. After I transferred $1,000, I realized I could have made it a little easier and transferred $500 per paycheck, but oh well, I didn’t. Of course, I could transfer $500 back to my checking if for some reason I need to, and then transfer again in the middle of the month, but I’ll try it this way for now.

* For some of you, $1,000 a month on groceries may sound like a lot. For others, it sounds like very little. This does not represent all of the money spent on food in our household. Ted and I keep our money separate. I buy groceries Mon – Thurs, he takes me to dinner on Fridays, and he buys groceries on Sat and Sun. We are a family of 3 adults.

** Does anyone else still use a checkbook with a paper check register? Just me? Once I went into a new branch of my bank to ask for some registers, and the teller had no idea what I was talking about. Whippersnapper.

What do you think? Does this sound like a good point plan to you? Do you spend a lot on groceries and like accumulating points? I’m kind of excited about it, now that I think I’ve got it figured out.

26 Comments

Sarah Jedd

Yes! this is a great idea and I ight do the same. I would obvi only be abke to buy SOME grcoeries, but I like the idea of getting cash back AND ALSO I get a rebate on my Csotco groceries already, so that would feel doubly awesome.

J

I’m not sure if it works for Costco or not…maybe? Or maybe that’s a ‘big box store’, like Target. But otherwise, yes, this is GREAT for groceries!

Sarah Jedd

I just meant that I’d get 2% back on Costco and 5% back at my reg store– SO MUCH WINNING

J

Oh, gotcha! And you go to Costco a lot, so TOTALLY WINNING!

Birchie

Anytime that you can get 5% cash back, my opinion is that you should! Especially for groceries. Sadly, 1,000 a month is not shocking.

It’s not a horrible deal to pay a $59 annual fee to keep $700 in rewards, but if you really won’t spend the money on travel, it might be worth it to cash out even if it’s for a lower value. You could renew the card this year and if you still have the points next year then cash ’em out. Or lay down the law and tell Ted you’re going out of town for a couple of weekends until the $700 is spent.

I usually don’t like to volunteer people for things, but I bet that Kyria would be delighted if you asked her for ideas on how to get the best value for your points.

J

If I cash the points on something besides travel, I will get $350, so that’s definitely a no. And you’re right, $59 isn’t bad to keep my $700. And who knows, maybe we’ll go somewhere or do something. I kind of like to keep these points for a big trip (like France, Alaska, Hawaii) rather than for a weekend away, but might change my mind on that this time.

PocoBrat

I’ve ceded most money decisions to my partner because I’m bad at numbers (I know it’s not very feminist of me :/). It’s possible he’s bad at numbers too, in which case, we’re truly fucked.

But yes, the 5% back on groceries seems like a good deal. Rakuten also gives money back (although I don’t spend so much these days, so the checks have dwindled).

J

Maya, LOL on the feminist thing. I’m the credit card points person in this house. Ted is not interested in the whole game of it. Sometimes he will put something on a credit card for points, but most of the time for smaller purchases, he just uses his debit card so he can be done with it.

We all need to play to our strengths, is what I say.

nance

Is it terrible that my whole brain sort of glazed over once you got into the specifics and bullet points? Stuff like this is Rick’s Domain. He is terrific at it and enjoys it immensely. I have to really focus and study and it takes me right back to elementary school when I actually used to stand up at my desk to do math because I found it so frustrating once it moved beyond basic addition, subtraction, and memorizing the multiplication tables.

Thank goodness for brilliant mathy people. Thank goodness I know a lot of them.

Like you.

J

Yet again, you and your birthday brother Ted are alike. He has credit cards with points, he could do these things, but they make his head hurt and he does not think they are fun, so they are my domain. Which is too bad because he could get points for those dinners and weekend groceries. However, we keep our money separate and have never fought about money, so it works for us.

AC

It seems a bit complicated to me. I have been using a points credit card for a long time, and I pay it off every month. I don’t use a cheque register, but I make a note of it and put it onto my budget spreadsheet. I keep that file pretty current.

J

I guess it seems complicated because I had some confusing getting started. The short version is – Like a credit card for points, but it’s a debit card for points, so you just load your money there first.

I agree, using cards for points only makes sense if you pay them off every month. Otherwise you’re losing money.

Margaret

I have two reward VISAs but tend to use only one of them since I don’t like to get an extra bill. I do use a checkbook because it’s easy to grab and check without logging into my bank and then scrolling to find what I’m looking for. I have the same issue with automatic payments; I don’t tend to check over the bill as closely as if it’s a paper one. I know I’m a dinosaur!

J

I’m a bit crazy on the credit cards. I pay them several times a week, sometimes every day. I think this PayPal thing will help with that in a way, because there is nothing to pay, I will just log it in my checkbook. And now I have a separate checkbook for PayPal. I’m a lot sometimes, and would not expect anyone else to do things this way! But it works for me and keeps my brain quiet.

Lisa's Yarns

Phil likes keeping track of points and things like that, so this is his domain. Most of our credit cards have a cash back offer. I mostly use my Delta Amex since I benefit from the accumulating points w/ Delta. Some people get status with an airline based on their credit card spending but I get status on the amount of flying I do, so it doesn’t really pay to try to spend as much on the Amex as we can since only I benefit from that. Phil would rather have the cash back! Even though I am a numbers gal, I do not enjoy trying to maximize points/etc. It just makes my head hurt. For awhile there, Phil had so many different checking accounts w/ special rates. You had to have a certain # of swipes each month to get the special rate, though. I did not participate because I don’t swipe my card all that much!

J

I haven’t opened any checking or savings accounts for bonus money, I assume those are what Phil had/has. Keeping track of swipes DOES sound complicated, but I guess it’s doable. I have my savings in High Interest Savings accounts, that’s the most I do in that arena.

My BFF puts all of her purchases on a Delta card I think..or maybe it’s a hotel. She has a high status on that, and gets a lot of upgrades. That works really well for her, especially since one of her sons is in school in England, the other is in Arizona, and she and her husband live in Pennsylvania. They do a lot of travel.

Nicole MacPherson

$1000 a month on groceries sounds pretty light to me – but then again, we rarely eat out. I am always amazed at how much I spend!

J

Yes, I will keep track and see…as I said, that’s for 4 nights a week, so maybe you might double it to get the real amount? We’ll see at what point I pass my $1k.

NGS

All of these credit card hacks stress me out so much. Bless all you who can manage all this. I’m just going to curl up under my desk and hope my credit card is good enough.

J

LOL, this one is a bit more work than the others because you have to load money on it first, and you have to choose your category for the month EVERY month. Probably not the best for you. You can bring your checkbook to the grocery store. 😉 (JK!)

Tobia | craftaliciousme

Any cashback is a win. So happy you ound this for you.

I need to put some effort into finding something like this here. We are not as big on credit cards in Europe and there are not as many programs. However we are using an AMEX card and pay all travel expenses and big purchases. The husband basically pays everything. I can use the card but its all coming out of the husbands account so i try not to do it on everyday stuff otherwise we loose track on who pays what.

I have loyalty programs on almost any availbe hotels chain. I sign up andsometimes it helps save and sometimes not. I dont book hotels and such just because I have some sort of program. It is more like I book and when they ask if I am a member I check if I have that card already. If not I see if I have instant discounts if not I forgoe.

It is not a real strategy so I am sure I could get much more money back if I did put more effort in.

Thanks for the reminder. One of those projects. Maybe I put it on my next 101 goals in 1000 days lists.

J

I guess we don’t stay in hotels enough, it hasn’t really occurred to me to sign up for a bunch of loyalty programs like you have done. I don’t know why, I guess I should. My IRL friends who do this are pretty loyal to one chain or another, as that is the best way to maximize points and savings.

San

Thanks so much for sharing this. I am also looking into earning more points/cash back. I am currently using an AMEX card to earn cash back but Paypal might earn me more…

I am glad to hear you’re spending $1000 for three people… I do think it’s a lot but I also don’t think it’s unusual these days… we spent $1000 for the two of us. It makes my skin crawl but we meal plan and we eat everything we buy, so it’s not like there’s a lot of room to save.

J

$1,000 is my guess, and that’s for 4 days a week. I think this card will help me get a better idea of how much I’m spending, so that will be interesting.

I don’t think I’ve seen a card before that gives you 5 points per dollar on a category all year long, so I’m really happy with this one.

Pingback:

Ernie

I jumped over here as soon as I realized that I missed this informative post in my return from Italy race to get caught up. I should probably use a card that gives me cash back on groceries. I spend over $400 a week, usually. Not including the $500 ever two weeks at Costco. Hopping back over to finish my comment at your new post – just to keep you on your toes. 😉