Keeping Track of the Tax Plans

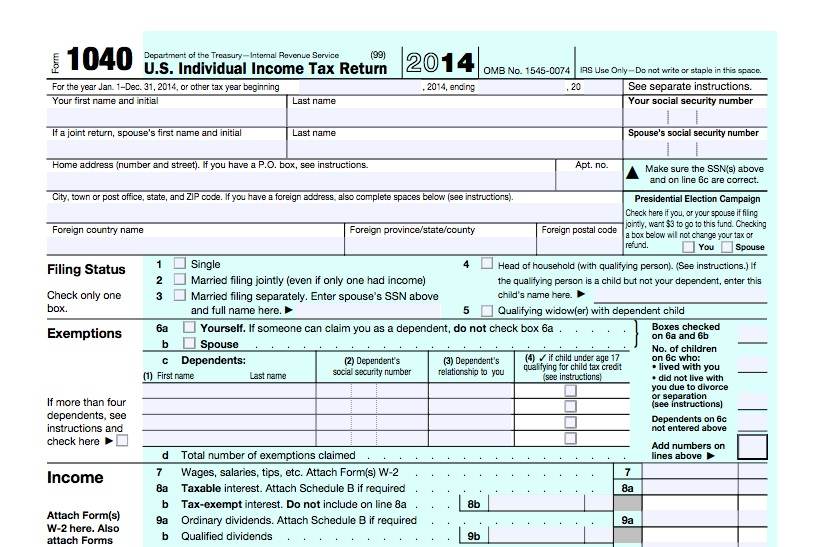

As you know, the House of Representatives passed a tax plan overhaul yesterday. I know that the Senate Plan will be different, and assuming they can get something passed, it will be some sort of reconciliation of the two. I thought it might be interesting (to me, if to no one else) to calculate how the tax plans would hypothetically affect our household. Since I don’t have numbers from 2017, what I did was to look at our 2016 taxes, and apply the numbers from the House plan, and see how we come out.

We have a mortgage, we live in a high tax state, and our daughter is in college, and the combination of these things (plus charitable contributions, etc) is higher than the standard deduction, so we itemize our deductions.

Under the House plan, we could itemize and claim deductions for our mortgage and property tax, but not our state and local taxes. The standard deduction of $24,400 is higher than our itemized deductions would be, so we would take that. The proposed standard deduction is actually higher than our current itemized deductions. But because you lose the individual exemption amount of 4,050 per person, our taxable income would be higher.

I applied the tax rates in the House bill, and if the House tax bill were to be the law of the land, our taxes would go up by $260. I do not mind paying $260 more a year if it goes to fixing the roads or helping people, but the idea that we would pay $260 more a year just so the wealthy can pay LESS taxes really frosts my cake. I don’t know what else to say about it, other than, it sucks and it pisses me off.

6 Comments

nance

*&$^&/!@ is all I can say (or think) about this BS tax plan. I got behind a car today with a sticker bearing 45*’s name. The exasperation I felt was palpable. So many idiots still unaware and oblivious.

J

That’s one good thing about living where we do. We don’t see TOO many of those kind of bumper stickers. Of course, we’re not immune, they are here too. Just not as many.

Ted

Another round of trickle-down economics during a time when the economy is relatively strong. What will these corporations and wealthy families do with their tax cuts? Hoard the money…like they have in the past. Very little, if any, “reinvestments” into the economy that would lead to more job and wealth growth for the middle-class. It’s a same con they’ve been doing since the ’80s.

J

It’s funny how we NEVER LEARN, isn’t it? I keep hoping.

Rain Trueax

I see the logic to not allowing state and local taxes to reduce what someone pays to cover the federal government’s expenses. It means states with less services are paying more toward the federal costs. That said, to change something on a dime, makes it very hard on families and especially the middle class. A lot of the deductions, like to churches, seems unfair to those who don’t believe in churches. We have a system in place that has long catered to this or that powerful lobbyist group. I don’t know how we fix it. We haven’t looked at how it’d impact us but I guess it might as we take a lot of deductions with the farm, rental property, investment income, book sales, and his consulting business. No standard deduction will cover all of that.

J

I see the logic in getting rid of a lot of deductions, as long as they adjust the tables so people don’t end up paying more. One thing about California, at least, is that we pay more in taxes to the Federal government than we get back, so I think it’s kind of fair for CA residents to write off their state and local taxes. But really, I’m all for getting rid of a lot of these deductions in a reasonable way. They do tend to benefit the wealthy. But I also think it would be better if they adjusted the tax tables accordingly. And if we pay more taxes, so be it, as long as the rich ALSO pay more taxes. If they get a cut, I want a cut.