Money Monday – Update

Update on my new PayPal Debit Card – Happily, I was right, you can select the same category for earnings every month. You have to wait until the first of the month, so I set a reminder on my phone for the first of every month, so I don’t forget.

From April 1 to April 13, I spent $477.48 on groceries*, and I earned $23.87 in cash back. I’ve been thinking about the money that I earn, and decided that I would like to keep this money separate from other money. So I could leave it in PayPal, or I could put it in another account. I have a high interest savings account, so I think I’m going to transfer my earnings there, and save it for vacation. That way it can earn a bit of interest.

For too many years, any savings I had sat in an account in my regular bank, earning almost zero interest. I heard about high interest savings accounts, but I’ll admit that I worried about the fact that they weren’t brick and mortar banks. I feared I would send my money away online and never see it again. We payed for Mulder’s chemotherapy with Care Credit, which was through an online bank. Once I had some experience with that bank and knew they were legit, and I saw that they have high interest savings accounts, I felt like they were safe. It’s been great.

In last week’s post, I was discussing my travel card and that I had points on it and was thinking about canceling it to avoid the annual fee ($59). I’m 85% sure I am going to do this. The trip that Ted and I are taking in May to LA will be more than $700, so I can redeem my points and cancel it, and just use my Apple Pay most places (except grocery stores), since it also gives me 2 points per dollar spent. I have about 6 weeks to decide, before my card renews. On the one hand, $59 is not that much money. On the other hand, at 2pts per dollar spent, I have to spend $2,950 to earn that much, and I can only redeem it for travel if I want to get the full value. It was well worth it when I didn’t have another card that performed as well with no annual fee, but now I do. So if I can get the points elsewhere, it’s probably better to cancel it.

In other money news, I finished our taxes yesterday. I usually do them earlier, but for some reason this year I waited until (almost) the last minute. We owe, but not a lot. I choose to think of it as an interest free loan from the government, which is a good thing. It’s just time to pay that loan off.

* Reminder that I buy groceries for 4 days a week, Ted takes care of the other 3, and we keep our money separate. I also went to Costco, but did not use my card there, as I would not have gotten the 5 points there. Now I have to decide whether I want to get another 2pt card with no annual fee for places where they don’t take Mastercard.

29 Comments

PocoBrat

I chuckled at your post’s title… then everything got too math-y for me. (Not complaining; I’m impressed.)

J

LOL, well, I suspect this will be the last one about points, so you’re in the clear going forward.

AC

I am wondering about the shoes. Red, I presume? ?

J

I’m guessing bright red, yes, with matching lipstick.

nance

What maya said. Again I rejoice that I have Rick, who enjoys doing all the mathy money stuff for us and is so good at it.

J

Thank goodness for mathy people, right? I’m more math adjacent than truly mathy, but I do like this stuff.

Ernie

Here I am, after bopping over to the post I missed last week in my blur after Italy. As I was saying (in that comment section), I should probably get a card that gives me cash back. We spend so much every month – and a shit ton on groceries. My long time/current go to credit card gives me American Airlines miles, which comes in handy when we want to travel – but those miles don’t help when we fly overseas (so when it counts!) because it isn’t worth it after fees. I wish Coach or I had a better handle on managing cards and knowing which cards to use, etc. Thanks for sharing these tips.

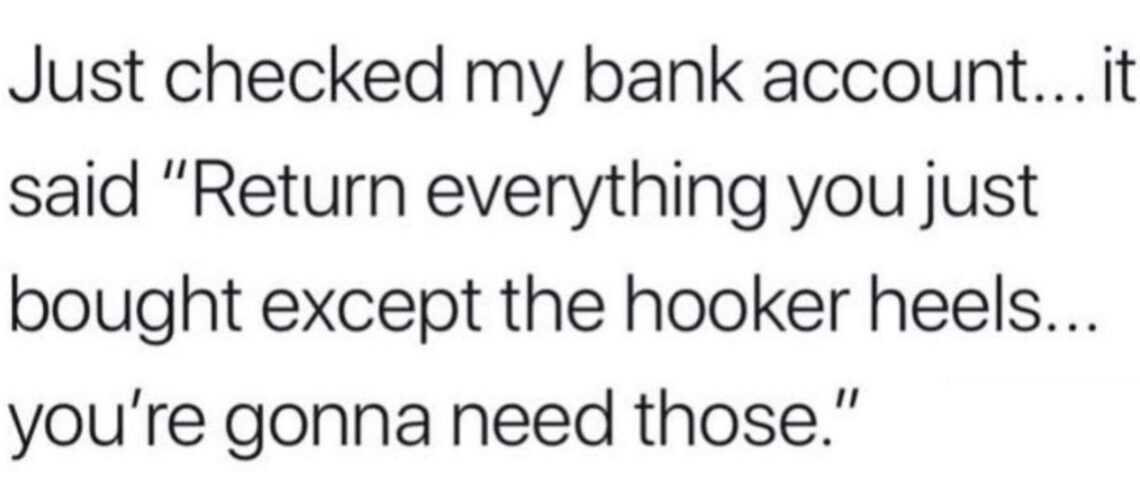

The quote at the top is hilarious.

J

I have 4 or 5 cards I use for different things to maximize points. There are easier ways to live one’s life.

Birchie

Woo hoo that you get to use your travel points before the annual fee is due! I don’t mind paying a cc fee if I can clearly see the value that I am getting from it, but there is a limit. That’s the one thing that bugs me about the Capitol One Venture X – everyone loves to tell you that you get $400 in free travel for the $395 annual fee…but either way $395 is going out of your wallet every year. I’ve got other ways to make $5. A lot of the travel hacking podcasts that I listen have done episodes recently where they’ve come to the conclusion that people who don’t travel are probably better off with a cash back card. In my mind 2% on everything is the gold standard, and there are so many of them out there with no fees. Of course you can find cards that pay more for specific categories, and of course it makes sense to use those as well for those categories, but there’s no reason to settle for 1% back on everything else.

YES YES YES to high yield savings accounts! I’ve used them for a long time. I also use a brick and mortar bank that has branches across the country, so I have the best of all worlds. I would never use just one bank. I’ve been on a tear of opening checking and savings accounts that have new account bonuses, and it’s been interesting to see how different banks do things.

J

Birchie, your current practice of opening (and I assume closing) accounts for the bonus is intruiging, but I haven’t gone that far.

I agree, the fee for the credit card wasn’t a big deal when I opened it in 2017, because it was the only one I found with 2%, and it had no foreign transaction fees, two things I wanted. Now I have those things on other cards, and while I can’t find EXACTLY the same combination 100% of the time, I don’t travel overseas often enough to make it worth paying the annual fee.

Margaret

I have a rewards visa that I’ve been using for groceries and other expenses but when the bill comes I nearly faint on the floor. (especially this month since I’ve been paying for my mom’s funeral expenses) Yikes. My husband and I kept our finances mostly separate and it worked for us. Some of my more traditional friends disapproved. (none of their business though)

J

This never happens to me because I am neurotic and pay my bill several times a week. Yes, WEEK. (Sometimes daily, if I’m being honest) So it never gets too large. I think I only paid it once a week when I was in France in 2022, and that gave me hives.

Suzanne

My husband and I were just discussing a United card, because it would cover its annual cost (plus $10) if my kid and I fly United once a year. But… that locks us in to United, and I’m not sure about that. This has nothing to do with your post at all, I just thought you would be able to commiserate!

I am curious about your high-interest savings account, which one(s) you like best and how easy they are to move money into/out of.

J

Suzanne, both Synchrony and Apple have high interest savings. I feel like a lot of banks do nowadays.

Transferring money to my brick and mortar bank checking account does take a couple of days, so that’s a consideration for sure.

NGS

I still do not understand anything about anything. I currently have two credit cards because my Capital One card changed from Visa to MC and MC isn’t accepted at Costco, so then I got a Chase card and I KNEW that this was a bad move for me and it proved to be when I forgot to pay one of them and HAD TO PAY A LATE FEE FOR THE FIRST TIME IN DECADES. The credit card companies are winning. Thanks, I hate it.

J

Ugh, I’m sorry. I am also sad that Costco does not take Mastercard, because now I may sign up for another credit card and Costco is a big reason. SIGH.

I would never forget to pay my credit card bill because I’m neurotic and pay it almost every day. I can’t stand to see the balance get too high. But if you rarely use it, it would be an easy thing to miss!

I once forgot to pay my electric bill, and freaked out when the next one came and the balance was so large. I said, GEEZ, THIS IS ABOUT TWICE WHAT WE USUALLY PAY! Yep.

Alexandra

Oh dear, I read ‘earnings’ as EARRINGS and wondered why you needed a separate category for earrings? Doh! I have Swiss cheese for brains some days. I blame it on being Monday.

In other gossip, me and mine use a Tangerine credit card for all our grocery and small household purcheses, thereby keeping that account separate from things like rent etc. It really makes it easier each month to track what we’re spending, and where. This also means we can pay that card off every month avoiding fees.

J

Paying the card off every month is KEY. The interest rates are so high, who wants to deal with that?

Alexandra

Oh, I couldn’t agree more.

Tobia | craftaliciousme

I really need to look into this but it is so much adulting. I dont feel I can handle it right this moment. But I am happy to read you are getting money back.

I have used an online bank for many years. One of the – also where my portfolio is – had a 5% interest rate for a couple of years (it is now down to 2.5%) and I parked a lot of money there that gave me so much money in interest I couldnt believe it.

J

I love the high interest savings! Yeah, the rates have come down, which is dissapointing, but I guess it means that interest rates are coming down, so that’s a good thing.

These credit cards are great, but only if you don’t carry a balance. This one is different, since it’s a debit card. So no worries about forgetting to pay and paying interest.

Jenny

HEE HEE. I like the quote at the top of the post. Like Maya, this got a little math-y for me, but that’s a bad thing. I really need to get more savvy with my money. Not that I’ll have any left soon, with what’s happening to our 401ks, but whatever.

J

Jenny, I haven’t looked at mine, I’m afraid.

Lisa's Yarns

High yield savings accounts are great! We used to have several at different banks but Phil has consolidated them in recent years. Sometimes there would be a deal where you would get a bonus if you moved $X to Ally, for example, and left it there for 6 months. Phil would track those sort of deals and tell me when to move money. That is totally his domain, though. I don’t care enough to track all the different programs and such. I think he did that back when savings rates were really low, though. These days there are attractive rates in a lot of different places so that might be why he’s cooled it on moving our savings around.

We just filed our taxes, too. Phil gets a good chunk of income on a K1 instead of a W2, and those come out far later in the season than W2s. We also owe a big chunk of money, though. We were explaining taxes to Paul this mroning and his take on the whole subject was “oh that’s cool!” I try not to be salty about how much we pay in because I know we are incredibly lucky to be in our financial position.

J

I get salty about paying too, even though I know it means that I made money on interest on my savings, and that I am paying to be a member of society. I generally vote to increase taxes when it comes up, because I believe in the things these taxes are going to support. I want to have it both ways, I guess. Not owe, and still have the benefits. And of course the disparity of the uber rich paying so little does get to me.

Kyria @ Travel Spot

Yay for HYSA! I am like Lisa (or Phil?) and I usually have a couple of accounts depending on the current deals out there. However, they started to become the same, so I started to consolidate and even closed one last year. I only pay my credit cards off once per month, all on the same day, so that way I can transfer money from the HYSA to my checking and pay everything all at once.

As for cash back cards, I just did a search for you and the best Visa right now seems to be the Bank of America Customized Cash Rewards credit card, which 3% back in category of your choice and 2% at grocery stores, including wholesale clubs, which a lot of them exclude. Also they have a $200 sign on bonus and if you are a premier member with them, added % cash back. However, they do have foreign transaction fees, but you could use a different card when you travel.

J

Thanks Kyria, for doing my research for me!

Stephany

This is super interesting! I keep seeing things about this Paypal cashback thingy and my eyes glaze over so quickly when it comes to stuff like this. I don’t know why! Maybe there are just SO many options and I don’t even know where to BEGIN. Maybe Paypal will be my secret entrypoint. I’m going to look into this!

J

I think it’s perfect for you Stephany. You don’t have to worry about interest, because it’s a debit card, not a credit card. And you get 5% back instantly.